July 1, 2022 Bulletin

What will ECB Rate hikes and Inflation mean for your Mortgage Payment?

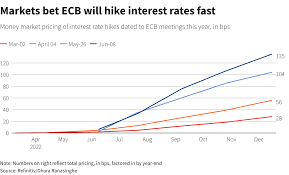

It has been all over the news that the ECB will hike interest rates in July, and they have also signalled a further increase in rates in September.

What is vital for us, as our paychecks are being squeezed by inflation, is to be able to predict and manage with higher Mortgage Payments.

Conservative experts are predicting a 0.5% increase in ECB rates in July, followed by a similar increase in September. If inflation fails to subside, there will be more increases. The writer believes that rates are likely to increase by in excess of 2.5% over the next 18-24 months using a pessimistic outlook.

Link: Is your Job burning you out?

Inflation has been stubborn over the last year; promises that it was short-term seem to have been overly optimistic. While Putin has a foothold in Ukraine, and the rest of the world is determined to reduce their dependence on energy imports from Russia, we should expect that our fuel and heating costs, if oil or gas based, will stay high.

While rates were low, affordability of a large mortgage has been fine in most households. It may be a different story when rates start to rise. Let’s look at the impact of a rise of 1% and 2% on average Mortgages:

| Average Term 25 year | 200,000 Mortgage | 300,000 Mortgage | 400,000 Mortgage |

| 1% Increase | 104/month extra | 160/month extra | 214/month extra |

| 2% Increase | 220/month extra | 331/month extra | 441/month extra |

| 3% Increase | 340/month extra | 510/month extra | 680/month extra |

Important Notes:

- These figures are estimates and based on repayment (principal and interest) loans. The increases on Interest Only and Tracker Mortgages may be higher.

- Some lenders calculate the basis of their Interest Charge differently – some charge at start of year, some monthly, so this would have a bearing on the payment.

Link: Can you cover your bills if one of you is ill or disabled?

For those who feel that the impact of a substantial increase in rates could cause them financial difficulties, you should seriously consider switching to a Fixed Rate Mortgage. You will see some brokers and lenders offering switch and save mortgages, but you should also ask your existing lender what they can offer first. This could save you money and time, and also avoid the hassle and credit underwriting that comes with a Re-Mortgage.

We have compiled a “Cheat Sheet” to help you look into what rates are available from your own providers. Anybody with KBC should act urgently – they are restricting actions on Mortgage customers after 15th July.

Some lenders offer “Green Mortgages”. These are available to those with a BER cert up to B3. Valuable if you qualify and may be worth investing in a BER study if you don’t have one already.

COSTINGS/COMPARISONS

There is a handy government agency to access to compare and quote different Fixed Rates: the Competition and consumer Protection Commission was set up to ensure fair treatment and clarity of information from Financial Services Firms. They have like for like comparisons to ensure you do not get distracted by shiny give-aways.

Get an indication of cost here:

All you need to do is fill in your existing mortgage details and value of home, and all your options will pop up – we would recommend looking 5-year fixed rates. In any event, you should pick a fixed term to suit your circumstances and your view of how long this interest rate and inflation cycle will last.

Lender Links

To make it easier for you, we have links to the major banks to start the ball rolling on a switch to a Fixed Rate. So many people start and lose interest when they find it messy or hard to locate what they need. We would urge you to follow through – get the best rate available to you for the term that suits.

AIB

https://aib.ie/our-products/mortgages/mortgage-interest-rates

Download the mortgage Amendment Form – see link on end of second last paragraph on page.

Bank of Ireland

https://personalbanking.bankofireland.com/borrow/mortgages/rate-table/

Very easy path to follow and apply for rate change

Permanent TSB

https://www.permanenttsb.ie/mortgages/mvr-switch-offer/

The first thing to do here is to follow route for Managed Variable Rate (valuation, etc, so you can return to the best rate once your Fixed Rate is over.

Please download the Replacement Mortgage Rate Switch Pack Request Form from the page to complete.

KBC

Any changes must happen by 15th July, otherwise you may need to wait until the move to Bank of Ireland takes place.

https://www.kbc.ie/mortgages/existing-customers/pdh-offer

Ulster Bank

Have a Limited amount of Fixed Rates

https://www.ulsterbank.ie/mortgages/mortgage-rates.html

Email Ulster Bank and they will respond with Quotes, etc

Q & A

What’s in it for Clevermoney, you may ask?

We want you to feel secure in knowing you will not have a surprise coming in your Mortgage Payments. This makes it easier for you to budget, so when we have a conversation with you about your Salary Protection or your Pension contributions, or about setting up savings plans for the kids, you will be more likely to engage with us knowing your free income is more stable.

What if Interest Rates do not rise?

If you lock into a fixed rate for a period, you have locked your payments. Regardless, when you look at the fixed rates, in most cases they are lower than the current variable rate you are paying, so you may have a win-win.

What if Interest rates are very high when my new fixed rate ends?

You will have the choice of going on to the variable rate available at the time, or choosing a new fixed rate. It is in the lap of the gods how long this cycle will last.

Will it cost a lot to lock into a fixed rate?

You may have to pay a valuation fee as many fixed rates are scaled on a loan to value basis. We recommend this as it is the opportunity to get lower rates than the rate you were offered when you purchased your house originally (probably at 90% loan to value), so if valuations now mean below 60% or 80% loan to value, you could get a nice reduction. We are primarily looking at taking a fixed rate with your existing lender – if you choose to move to a new lender, you will have a larger outlay, including legal fees.