Combining elements that you understand is the smartest way to create a secure retirement.

By: Jijo Joy, Senior Financial Adviser, Clevermoney

Sometimes we have all the elements for a great retirement, but until we put them together the right way, we don’t get the result we want.

I call it the H2O problem. We have plenty of oxygen in the atmosphere. Likewise, hydrogen. It seems simple, but until two atoms of hydrogen combine with one of oxygen, we will never get water.

Job Burning You Out?

When planning for retirement income, it is risky to wait for the right combination of elements to join on their own. They don’t just fall into place; you have to know what each can do and put them together in a way that produces a whole greater than the sum of the parts.

You may sit with financial advisers who can describe all the elements required for a successful retirement, including Pensions Transfer Ireland, but they might not offer all of those elements in their own retirement planning practice. Maybe it’s because of regulatory or business model considerations. And even when all these elements are available, the adviser may not know how to assemble them.

It’s not easy. Retirement income requires consideration of many more elements than just the two needed to create water (H2O), and many more combinations — like 50 trillion. Literally.

The Requirements of a Plan for Retirement Income

As a starting point, your plan should be about income: starting income to meet your current needs, increasing income to help offset inflation, lifetime income so you don’t run out, and less volatile income so you feel secure.

Can your Retirement Plan handle a Market Fall?

But most investors have additional concerns, such as a legacy they want to pass on to kids and grandkids, and availability of liquid funds in case of unexpected needs or emergencies. They might also want the plan to be convenient and easy to manage, with income payments made on a regular monthly basis, and flexible so that the plan can adjust to changing circumstances or economic conditions.

And the plan elements should be easily understood, offered by highly rated companies, low-cost and tax efficient. Bottom line: Focus on the plan and make the elements as time-tested as possible.

Identify the elements of a successful plan for retirement income

Just like in chemistry class when reviewing the periodic table, go to the list of financial products available to investors like you and select those that make sense. Or ask your advisers for their list.

Here is our list of retirement plan elements (including the most likely savings source):

- PD: Portfolio of high-dividend stocks (invested from Defined Contribution (DC) Pension or personal savings)

- IAN: Income annuity with guaranteed payments starting now (From Defined Benefit Pension Scheme, or part of a Defined Contribution Scheme)

- PF: Portfolio of fixed income bonds (invested from DC Pension or personal savings)

- ARF: Income annuity with flexible payments starting at future dates you select (invested from both DC Pension or AVCs)

- PB: Portfolio balanced between growth stocks and fixed income securities (invested from DC Pension or AVCs as source of withdrawals)

Here’s a picture of how the elements might look if you were creating a retirement molecule.

Courtesy of Clevermoney

Putting the Elements Together

As a compound your plan might look like PD3IAN4PF1ARF2PB4. However, and this is the tricky part, unlike this jumble of elements, the compound you’ve engineered needs to be designed to be able to change form over time and continue for your entire lifetime.

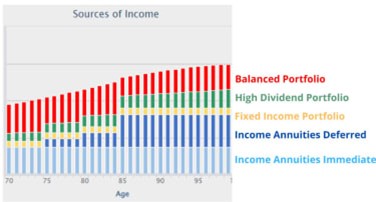

The bar chart below demonstrates the income these elements produce when combined using the Go2Income planning algorithm. Note how each element contributes different amounts at different times over your lifetime. Of course, the portfolios will contribute income based on the planning assumptions, while the annuity payments are guaranteed* and serve as the plan’s foundation.

Courtesy of Clevermoney

Results of Your Plan

To evaluate your plan, see if it meets your income requirements: starting income to meet your current needs, increasing income to help offset inflation, lifetime income so you don’t run out, and less volatile income so you feel secure. And also look at your objectives for legacy and liquidity.

Unlike H2O, there are virtually an infinite set of possible combinations to match your objectives and personal circumstances.

In the end, creating a successful plan will allow you to:

- Use basic elements in the most effective and efficient way

- Create a plan that combines the right mix of elements

- Personalize the combination to meet your objectives

If you are interested in working on your own “chemistry” project, visit the Pension section at Clevermoney.ie. Feel free to complete the How can we help you form, and we can contact you to get more information to design a plan that meets your objectives.

* Guarantees are subject to the claims-paying ability of the insurer or Company that underwrites the Guarantee.

* The value of Investments may fall as well as rise. Please seek professional advise to ensure that your decisions reflect your approach and capacity for risk.

Jijo Joy is a Senior Financial Adviser with Clevermoney and can be contacted on 085 2610741 or jijo.joy@clevermoney.ie