Ukraine – How Could it Affect Your Investments?

Russia’s invasion of its European neighbour is extending 2022’s volatility in the stock and commodity markets.

Russia’s invasion of Ukraine is sending shockwaves through pretty much every asset class across the globe. Risk assets such as stocks are tumbling. Traditional safe havens like Bonds and gold are rising. And oil and other key commodities are spiking at a time when Irish, EU and U.S. inflation just hit a four-decade high.

But as disastrous and disorienting as the impact of Europe’s largest military conflict since World War II might be, the best course of action for most retail investors is to keep calm and carry on, market strategists say.

Equally important is the fact that no one knows what Russia’s invasion of Ukraine ultimately means for everything from energy prices to monetary policy.

And then there’s the case that, historically speaking, stocks tend to recover quickly after being derailed by international turmoil.

Russia-Ukraine’s Impact on the Broader Investment Market

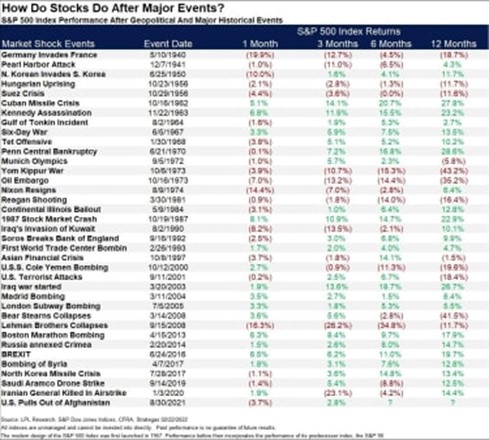

“Geopolitics rattling markets is nothing new,” says Lindsey Bell, chief markets and money strategist for Ally Invest. “It’s typical that the immediate reaction to geopolitical events is the most dramatic. The good news is that the impact tends to be short-lived, only lasting anywhere from one to three months.”

Most importantly, history shows that 12 months after events such as our current crisis, the market edges higher, Bell adds.

Can your Retirement Plan handle a Market Fall?

Indeed, the market’s record is one of resilience amid times of strife, notes Ryan Detrick, chief market strategist of LPL Financial.

“As devastating as a major conflict could be between Russia and Ukraine, the truth is that stocks likely will be able to withstand the geopolitical struggle,” Detrick writes.

Have a look at the table below, courtesy of LPL Financial, a U. S. based Financial Adviser (www.lpl.com), which shows past market performance following major geopolitical or historical events since WWII.

“Bottom line is if there isn’t a recession, stocks tend to take most in stride,” Detrick says.

LPL Financial

But that doesn’t mean Wall Street and other Investments won’t suffer some serious short-term disruptions.

Oil Takes the Spotlight

The current crisis has rippled across commodities markets. Global benchmark Brent crude oil futures topped $100 a barrel for the first time since 2014. Consumers can expect higher prices at the pump – and soon – with €2-plus-per-litre gas becoming the new norm.

It’s important to remember, however, that $100 a barrel is a nominal price. Adjusted for inflation, crude would need to top $120 a barrel to reach 2014 levels. The last time we got there, U.S. shale oil producers burned through roughly $500 billion in capital to lift production – and crude prices crashed in short order.

While OPEC countries have been mostly silent in relation to efforts to curb oil price increases (why would they – as they are profiting from the crisis), the U.S. has also entered the fray in battling the price of oil. Joe Biden has promised to take action to release reserves and look at increasing production of both oil and gas to help wean Europe off their dependence of Russian supplies. Don’t expect this to be long-lasting if Biden comes under pressure to satisfy local demand or prices.

Inflation Fears Ramp Up, making Investments jittery

Action across other commodities markets is likewise adding to inflation anxiety. Prices for a number of agricultural commodities are jumping, as Russia and Ukraine together account for about 20% of global corn exports and €30% of global wheat exports.

Watch Wall Street Journal Video about Commodity Price hikes

Whereas we in Europe will feel the inflationary pinch following price increases for grain, much of North Africa is dependant on Russia and Ukraine for over 50% of their supplies. Expect to hear more about global hunger and famine in late 2022 to 2023.

Last month, the Irish Government gave the green light to incentives to increase crop production, to replace some higher-priced imports, but as crops are planned up to 24 months in advance, it will not be enough to replace the 60% of imported grain that is used in Ireland, according to Charlie McConalogue, Minister for Agriculture

Dept of Agriculture Grain Support Package

We are not heading for a classic Recession, when Inflation forces increased Interest rates, followed by a drop in consumption, followed by reduced production, followed by increased unemployment.

The inflationary forces on this occasion are more defined. Energy Prices were drifting upwards prior to the Russian invasion of Ukraine – this was more of a catch-up on reduced consumption during COVID and a slow reaction to OPEC having turned the taps down during COVID. Then came the supply issues and sanctions against Russia, which is a major contributor to oil supply globally. Wage inflation had grown as more people had looked at their life choices during COVID and decided to change careers, return to education, and thus caused pressure in the posts that needed to be re-filled.

We are now in a situation more easily described as War-flation. I call it supply-depleted inflation, as it was starting prior to the Ukraine War. In these cases demand grows, yet supplies are limited. Covid caused a fall in supply of many Chinese supplies, including Chips for cars. It caused a fall in Labour supply as many people changed careers or immigrants returned to their home countries during lockdowns. Ukraine has triggered increase in food and metal commodities, due to Ukraine being the breadbasket of Europe, and War ordnance uses a lot of metals.

Longer term, assuming no serious escalation of the Ukraine war, prices will stabilise. We are not done with inflation – it’s here for another year or two, according to Forbes Magazine.

Take the appropriate steps to protect your assets during this time. Be sure to make sure your income keeps pace, but ensure you have proper Financial Advice before looking at any drastic changes.

Joe Carroll

12/04/2022

Joe Carroll is Practice Director with Clevermoney. Clevermoney are Financial Brokers and Wealth Managers with a nationwide presence. www.clevermoney.ie